|

Getting your Trinity Audio player ready...

|

Investing in property is a lucrative market and a good place to look if you are interested in starting out in the world of investment. We have put together 4 tips for investing in property.

1) Start Out Carefully

If investing in property is new to you, it is critical to start out carefully and spend time on research. It is wise to consider how you will invest in property. For example, buy-to-let, house flipping, and real estate investment trusts are all viable ways to begin.

You also need to consider your goals and what you want to see as a return from your investment. Do you want rental income, capital growth, or both? It will become easier to find the right property for your needs and wants if you have clear objectives.

2) Research the Location

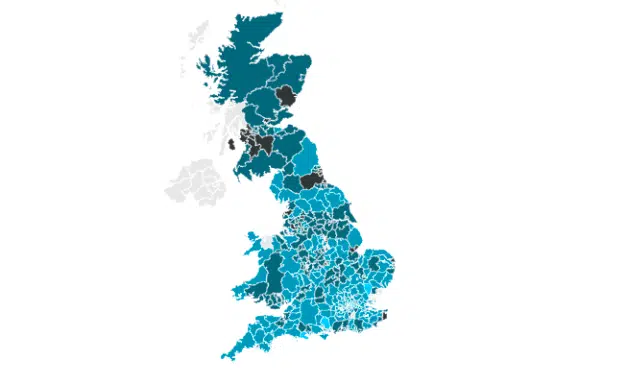

Location is a key factor when it comes to the success of investing in property! Research market trends in the area and be certain of how desirable the location is. ‘Up and coming’ areas with good facilities and public transport are likely to see house prices increase.

If you are investing in a buy-to-let property, a desirable location can make it much easier to find and replace tenants quickly. Furthermore, if the property market continues to grow in the area, you will have an improved chance of capital gain on your property. Check out our blog on rental yield trends across London Boroughs.

3) Be Clear on How You Will Finance the Investment

The valuation of a property and your personal circumstances will often impact how you finance your property investment. There are various ways to finance investment including buy-to-let mortgages, bridging loans, auction finance and commercial mortgages.

Furthermore, you must consider how you will finance other costs such as legal fees, materials, labour and utility bills. Careful budgeting is key, as these costs will also impact your financing and return on investment.

A top tip is to compare and research different financing options then work out which is the best fit for you and the property you are investing in.

4) Hands-On or Hands-Off

You may have a higher opportunity to generate profit if you are hands-on with the property. This includes finding tenants yourself, fixing and improving the property through DIY, and maintaining the property. While this can save significant costs, it comes with additional responsibility and is time-consuming.

On the other hand, you may wish to invest with a hands-off approach. This passes certain responsibilities on to third parties such as letting agencies who can manage the property for you. This may be a more suitable approach if you are limited by time or own multiple properties. However, it will be a costlier option.

This tip is important as you consider how much income you plan to make from a property investment. Decide which approach you will take, and then factor this into your projected return on investment.

If you are interested in starting out in property investment, Property Deals Insight gives you a comprehensive range of property investment data and insights. This is a great way to understand the market and know where to invest. Also, click below to visit our page about strategies on how to approach property investment as a professional.