|

Getting your Trinity Audio player ready...

|

With property prices continuing to rise, it is becoming harder to take that first step on the property ladder. As a result, many UK residents are renting properties instead of buying them, this has led to an increased demand for rental properties. We will explore current demand, letting times and areas of opportunity for buy-to-let property investment.

What is the current demand for rental properties in the UK?

There is a strong demand for rental properties across the UK which has been driven by a continued increase in property prices. According to gov.uk the current average price for a property in England is £249,633 making owning a property an unattainable goal for many UK residents.

With property prices at an all time high, limited supply of properties and a growing population for many the only choice they have is to rent. The high demand for rental properties in the country makes buy-to-let a great investment opportunity and one that we will discuss later in this blog. Across the UK people are looking to move out of their current area for work, greater opportunity or to start a fresh post-pandemic. As this is the case for so many, a rental property allows for greater mobility should an opportunity to further their career or enhance the life of their loved ones making renting very appealing.

The perception maybe that flats and apartments are the types of properties that are rented the most when in reality, the increase in property prices has resulted in many 2,3 and 4 bedroom homes also joining the rental market. The addition of these property types presents new opportunities for landlords as they can now rent to young professionals, families and couples depending on property type and location.

How long does it take to let a property?

If you are a landlord then we have some great news for you! Current due to the limited supply of housing and high demand, research from Estate Agency Hamptons revealed that in April 2021 it took an average of just 8.9 days for a landlord to let a property, whilst properties in the countryside took an average of just 8 days to let, down from 31.9 days in April 2019, mainly due to residents wanting outside space thanks to the pandemic. A major benefit of the reduction in time it takes to let a rental property, is that landlords can minimise the time a property is empty and not providing rental income.

Whilst this is great news for landlords, the fast turnaround of properties is not so great for renters as the best properties and deals are being snapped up quickly. The limited supply of properties is making it harder than ever for renters to find their ideal homes, as with such short let times most properties are off the market within days.

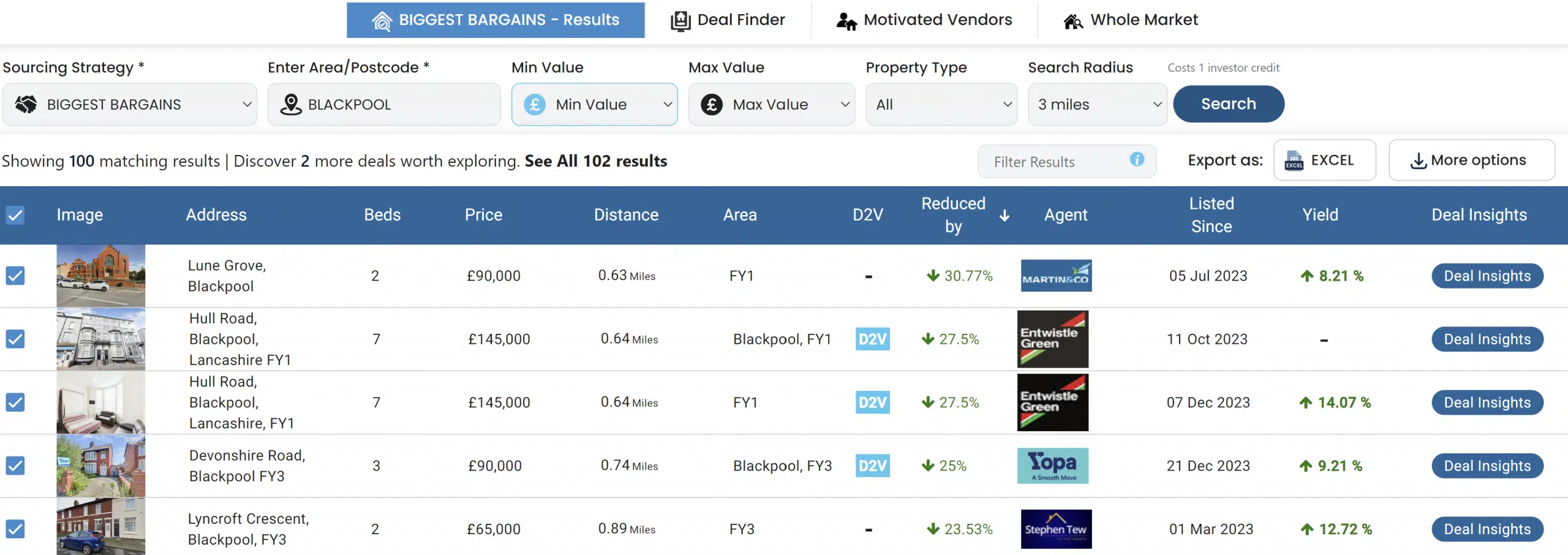

Where are there opportunities for buy-to-let property investment in the UK?

With such high demand for rental properties, where are the rental yield hotspots in the UK that can provide great opportunity for investors looking for buy-to-let properties?

The Midlands

All areas of the midlands continue to see growth and form the top section of Property Deals Insight yield hotspots. Areas such as Rutland, Rugby and North West Leicestershire are currently seeing average yields of 11.95%, 7.74% and 7.61% respectively. With many businesses opting for a second office in the midlands and lots of great schools in the area, there are plenty of opportunities for buy-to-let investors in the midlands that will provide a strong yield.

The North of England

It may come as no surprise to some, but as the north of England continues to see investment in infrastructure and industry, this area of England can provide a wealth of opportunity for buy-to-let investors, especially for those who may be beginning their property investment journey as property prices are generally lower than properties in the south of the country. South Tyneside, Bradford and Wigan are all in Property Deals Insight’s top 10 yield hotspots in the UK. The north of England is definitely an area on the up and could provide fantastic yield opportunities for investors.

City Centres

Despite many choosing to move out of city centres as a result of the pandemic, lots of people still want to get a taste of city living. London is still providing great rental returns for investors as well as many regional city centres like Manchester and Birmingham. Regional city centres are seeing rapid growth thanks to continued investment, making these areas a great place for investors to purchase buy-to-let properties.

If you would like to find out more about rental yield hotspots and average rental prices for properties across the UK, take a look at the plans we have on offer and utilise Property Insights tools.