|

Getting your Trinity Audio player ready...

|

Beginning your investment journey can be both exciting and daunting in equal measures. In this blog we will discuss how important experience is when investing in property as well as some tips to help you make informed, property investment decisions using Property Deals Insight tools.

Is experience essential when investing in property?

In short, no, experience is not essential when investing in property. Of course, having some previous experience of the process and knowing what to expect is helpful. Having previous experience can help you make better choices, but it is not the end of the world as everyone must start somewhere.

If you are unsure about the property investment process, then join a joint venture or partnership with an experienced investor, as this will likely provide you with much-needed comfort as well as advice and guidance. You can find experienced investors online via forums or social media. A call or coffee with an experienced investor will give you a better insight into what to expect and maybe even some insider tips.

Do you want to jump straight into the deep end? Then carry on reading our blog for some tips on what to look out for as well as information about how our tools can help you make informed decisions. Also check out our page on property investment strategies.

What to consider if you are new to property investment?

There are so many things to consider when looking to start investing in property. We are going to focus on three of those to get you started. Three very important things to consider are: finance and investment goals, ideal buyers or tenants and where you’d like to invest.

1.) Finance and investment goals

Investing in property is a big financial commitment, so it is important to consider how you will finance your investment and to have clear investment goals. Let’s begin with financing. There are several ways you can finance a property investment including: joint ventures and partnerships, a mortgage, or an investment fund. When deciding how you are going to finance a property, it is important to consider the costs and expenses that are associated with property investment. These costs include: stamp duty, surveyor costs, solicitors’ fees, and insurance to name a few.

Before investing, it is vital to decide what your investment goals are going to be. Are you going to be investing in buy-to-let properties for additional income, or are you going to take the ‘flipping’ route and renovate houses in order to make a profit? Defining your goals will help shape your property investment strategy. Read our blog ‘5 Reasons for investing in a UK buy-to-let property‘ for more information about the benefits of this type of investment.

2.) Ideal buyers and tenants

When deciding to invest in property it is important to consider your ideal buyers or tenants as this will govern where the property is and what type of property you invest in. There are a wide range of buyers to consider, including the two most popular, families and young professionals. The same can be said for tenants and, alongside families or young professionals, you may also want to consider students. Students can prove to be great tenants for flats or HMO properties.

3.) Choosing where to invest

The location you choose to invest in will play a large role in your property investment strategy. When deciding on your location, it is important to research the following factors:

- The average price of properties

- The average rental yield of properties

- Schools and facilities in the area

- Proximity to local amenities

- Transport links

Property Deals Insight have a range of tools available to help you choose your location, we will discuss these in the next section of this blog. Also check out our blogs on house price trends and average rental yield for properties across London.

How can Property Deals Insight help me make property investment decisions?

Property Deals Insight has a range of tools available to help investors make more informed decisions when investing in property. The tools we currently offer are:

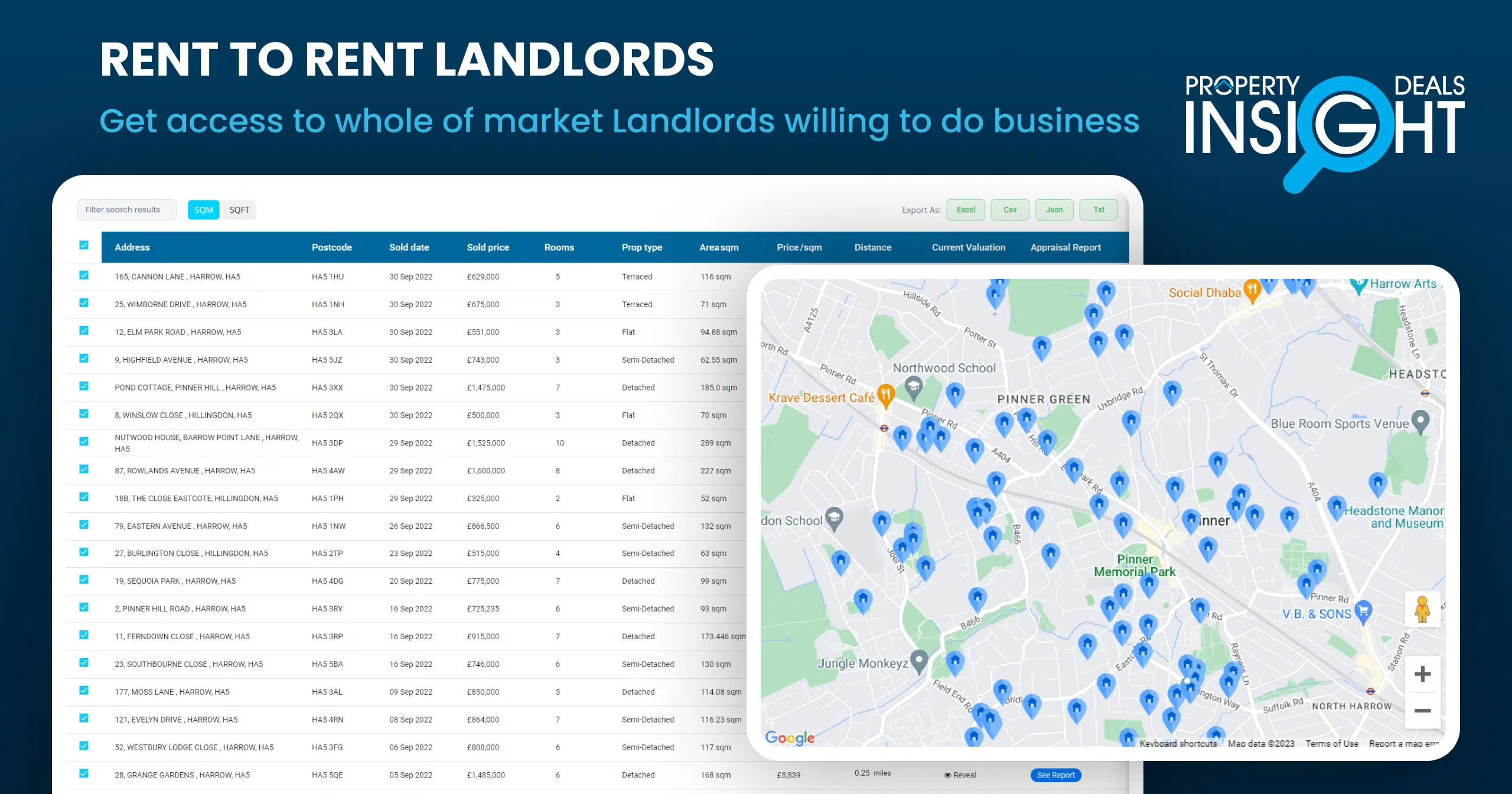

- Property hotspots – information on highest yield and growth areas in the UK.

- UK property averages – find information on the average sale and rent prices by property type or bedrooms.

- Deal Finder – save time and money with our deal finder. Find hidden gems to suit your property investment strategy.

- Instant property valuations – analyse a property in seconds and discover how much it is worth, as well as gain in-depth property insights.

- Generate deal packs – list your investment properties and generate PDF or interactive deal packs of your sales, rent-to-rent, rent SA/HMO and development appraisals supported by millions of data points.

For more information on our property insight offering please contact our team or sign up to claim your free access.