|

Getting your Trinity Audio player ready...

|

Ever heard of the term rent-to-rent? Like others, have you been intrigued by exactly what it is?

It has been one of the hottest topics in the real estate industry lately, and the clue is actually in the name, but how does it work?

- You’re going to rent a property from a landlord

- So you can rent it out yourself to another tenant

It’s cheap to get started

No deposits. No mortgages. No legal costs or stamp duty. Can it get cheaper than this? Unlike buying a property, you don’t need to pay a down payment or take out a loan.

It’s flexible

There are various business models that you can try, most of which allow for short-term or flexible rent. With different options, you have control over how you want to manage your rent-to-rent property.

And tax efficient

Because you’re not buying the property, you’re not responsible for paying the tax! (although you have to check in with the landlords/s to see if they’re paying on time).

Property Investor Today: Rent-to-Rent: the 'hottest strategy' for new investors

Property investors are always looking for new strategies and Rent-to-Rent has recently risen to the top of the popular strategies list. So, how does it work?

Read More

Property Reporter: Rent-to-Rent - will it become the norm for 2021 investors?

Rent-to-Rent is now talked about more and more in property circles. It’s been around for a long time, but as property prices rise investors need bigger and bigger savings to purchase property and Rent-to-Rent offers ....

Read MoreHow to manage rent-to-rent properties?

There are three basic models on how you can manage your rent-to-rent properties.

- Single Let (landlord accepts a discount)

In this scenario, the landlord is guaranteed an income stream without the usual risks and hassles of renting out a property.

- Turn the property into an HMO (House in Multiple Occupation)

If you have a deal for a 3-bedroom property, instead of renting it out to a single-family, you can rent it out as 3 separate rooms.

- Turn the property into serviced accommodation

Think of Airbnb or hotels! Serviced accommodation is similar since you’ll only be renting the property on a weekly or daily basis.

We recently did a deep dive into why more investors are choosing the rent-to-rent model in our article in the Property Reporter.

Finding rent-to-rent opportunities can take a lot of time and effort.

Fortunately for you, our Deal Finder makes it easy with sourcing strategies such as Short Leases, Repossessions, New Builds, Licensed HMOs, and many more!

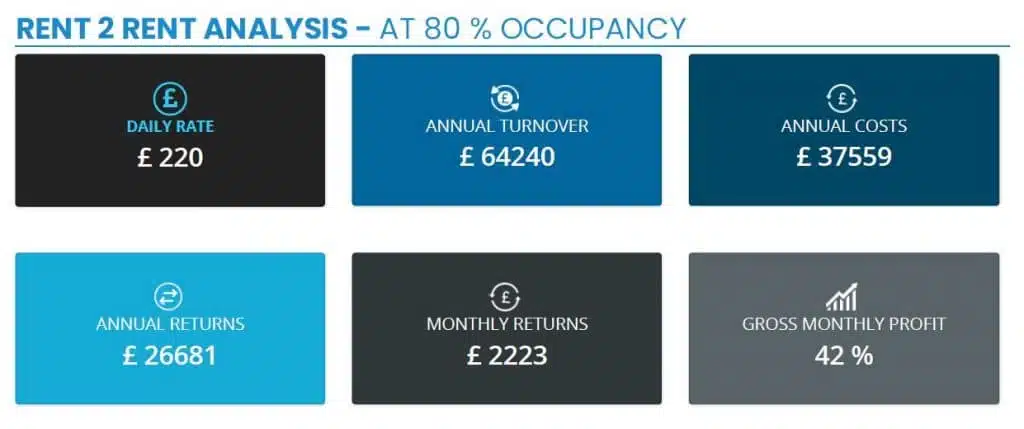

With our rent-to-rent property analysis, there’s no need to spend long hours fiddling with excel sheets and calculations.

Check out our Rent 2 Rent page with a video on “How to Find Direct-to-Vendor Rent-to-Rent Deals” to get started with your Rent-to-Rent journey. It’s packed with tips and tricks to help. https://www.propertydealsinsight.com/rent-to-rent

With just a click, this tool will help you:

- Work out what rent you can charge at various occupancy and price points

- See the returns on your outlay and the profitability of a property

- Ensure you haven’t forgotten to factor in all your outgoings

- List your rental properties in our Deal Finder to generate leads

- Generate Branded PDF Deal Packs & Reports

Once you get a few properties up and running, you can earn £30,000 a year for working less than 40 hours a week (with 5 rent-to-rent properties).

If you have any questions or feedback please reach out to us via email – info@propertydealsinsight.com or give us a call on 02033898222.