|

Getting your Trinity Audio player ready...

|

In recent years, house prices across the UK have soared making it harder than even for first time buyers to get on the property ladder. That being said, if you are a property investor, now is a great time to invest as property trends look set to continue to grow over the next few years. In this blog we will provide a general overview of the current state of the property market in England; 3,5 and 10 year trends in London and three of the areas in London with the highest property prices.

Property prices in England continue to grow slowly despite the current uncertainty that the Covid-19 pandemic has caused. According to gov.uk, house prices in England saw a 0.4% increase between April 2021 and May 2021. The increase in property prices has partially been driven by limited supply and increased demand, as people look to move to properties with outdoor space that are closer to amenities and parks following multiple lockdowns.

It is no surprise that London properties were impacted by the pandemic with less people wanting to live in the city, properties in London saw an increase of 5.2% between May 2020 and May 2021. London saw the lowest annual growth compared to the rest of the country with the North West seeing the greatest annual change in property prices, with an increase of 15.2%. The fact that property searchers have been looking for properties with outside space is supported by gov.uk‘s statistics that show flats and maisonettes saw the lowest growth, just 5.5%, compared to detached and semi-detached properties that saw an increase of 11.0% and 9.6% respectively.

Relying on the last 12 months when making a decision on property investment is perhaps not the best decision, especially when the last 12 months were a pandemic. So to make your investment decisions slightly easier, Property Deals Insight has collated 3, 5 and 10 year house price trends, to make deciding where to invest in London, simpler.

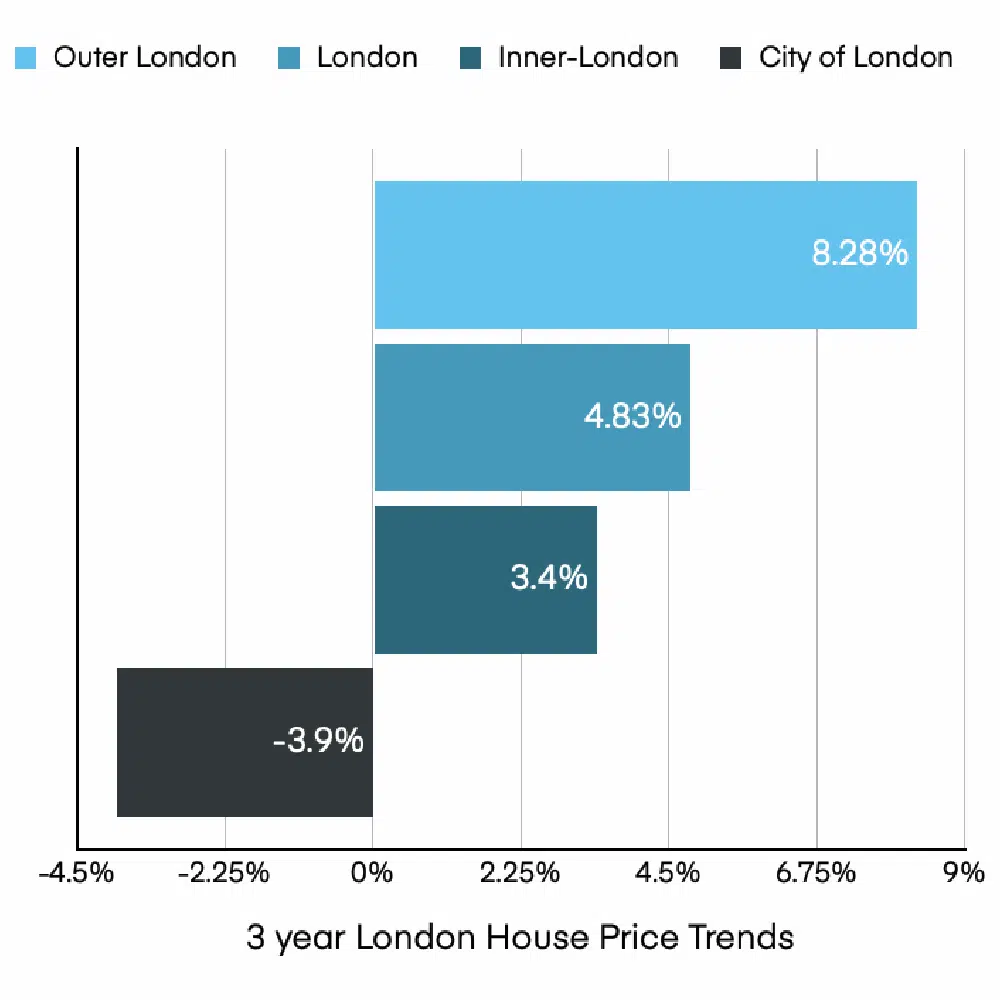

3 year London house price trends

Over a 3 year period, the City of London is the only London area that has seen a reduction in property price growth. All other areas of London have seen a 3-10% growth on average. The graph below indicates the growth of each area.

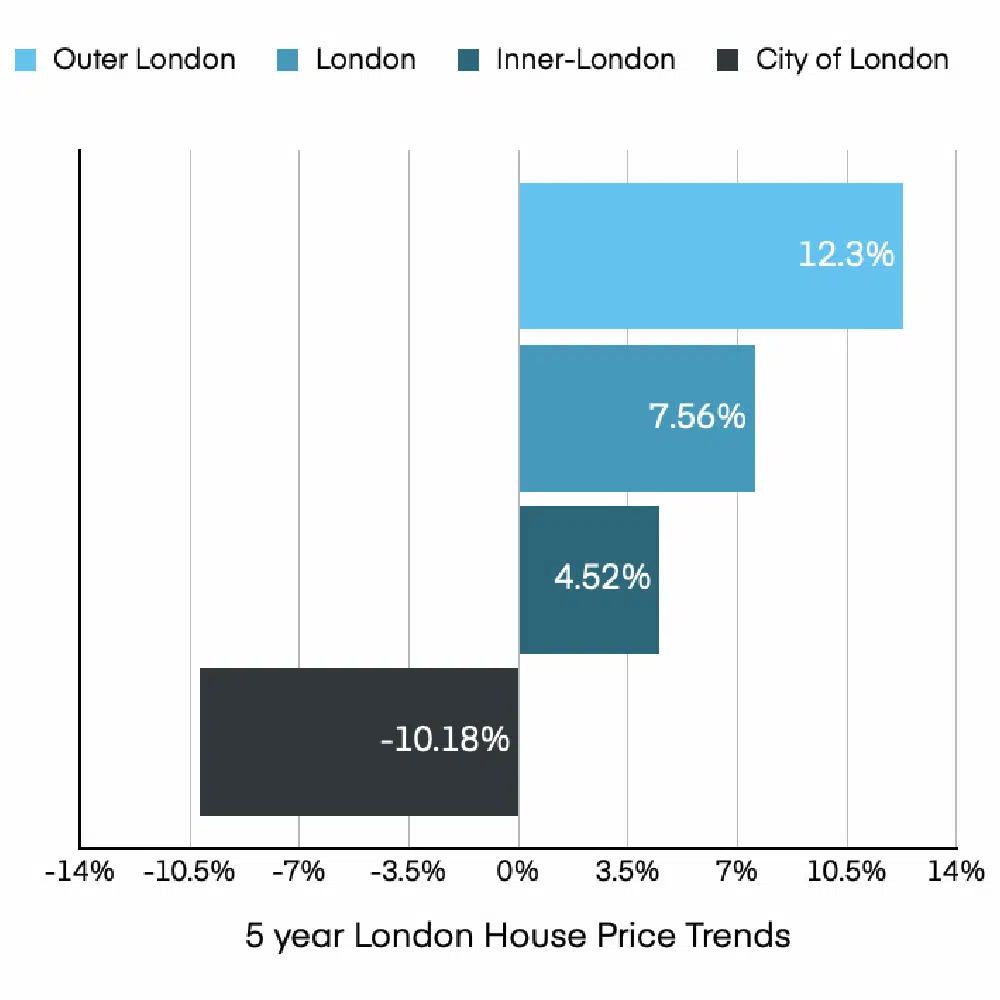

5 year London house price trends

5 year averages also show that the City of London has seen a reduction in growth, this could indicate that investing in other areas of London may provide greater resale value than the financial district in the future.

10 year London house price trends

Property Deals Insight’s findings indicate that over a 10 year period all areas of London have seen significant growth in property prices, with outer London including areas such as Ealing, Harrow and Richmond-upon-Thames, seeing the strongest growth.

Top 3 areas in London with the highest property prices (based on a 2 bedroom property)

(1) Southwark

This is a beautiful London borough that is home to many iconic London landmarks including Shakespeare’s Globe Theatre and The Tate Modern. For those more in to cuisine than culture, you can take your tastebuds around the globe when visiting Borough Market. For a two bedroom property in Southwark the average price is £1,481,269.

(2) City of London

Also known as the financial district, City of London is home to some of the highest earners in the UK. Rich in financial history, you’ll find contemporary apartments as well as characterful properties. For a two bedroom property in the City of London prices average around £1,460,771.

(3) Westminster

This offers fantastic investment opportunities for investors. In the heart of London, the area is full of affluent individuals as well as being popular with international businessmen and women. In this area, a two bedroom property comes in at an average of £1,377,470.

If you would like to delve deeper into house price trends in London, sign up for a free trial and visit our house price trends page where you will be able to carry out further analysis.

2 Comments

Comments are closed.