This website uses cookies. By continuing to use this site, you accept our use of cookies and also consent to our privacy and GDPR policy Learn More

We use cookies to help you navigate efficiently and perform certain functions. You will find detailed information about all cookies under each consent category below.

The cookies that are categorized as "Necessary" are stored on your browser as they are essential for enabling the basic functionalities of the site. ...

Necessary cookies are required to enable the basic features of this site, such as providing secure log-in or adjusting your consent preferences. These cookies do not store any personally identifiable data.

No cookies to display.

Functional cookies help perform certain functionalities like sharing the content of the website on social media platforms, collecting feedback, and other third-party features.

No cookies to display.

Analytical cookies are used to understand how visitors interact with the website. These cookies help provide information on metrics such as the number of visitors, bounce rate, traffic source, etc.

No cookies to display.

Performance cookies are used to understand and analyze the key performance indexes of the website which helps in delivering a better user experience for the visitors.

No cookies to display.

Advertisement cookies are used to provide visitors with customized advertisements based on the pages you visited previously and to analyze the effectiveness of the ad campaigns.

No cookies to display.

Property prices are soaring and for a high number of people, they are too high, which makes finding the right property investment strategy in the UK difficult. Repossessions can be an interesting opportunity to find a property with a good price. Lender enforced sales are a great way to buy a Below Market Value (BMV) Property. Repossessed properties are property that lenders seize when the previous owner defaults on the mortgage.

It can be worth it, but besides bargains, there are also several pitfalls.

The repossession of real estate is possible if it serves the common good. However, the definition of the common good can be interpreted in many ways. For example, infrastructure measures – such as road construction or the expansion of the rail network – are considered to be in the general interest. As a general rule, repossessions are always a last resort. An alternative could be to oblige owners of undeveloped land to build properties instead of initiating expropriation. This, too, could serve the common good (in this case, more housing). Other reasons for repossessions can be

a financial emergency, disputes among heirs or a breakup.

In these cases, the property must be sold quickly which means that buyers can make a bargain with these houses. Nevertheless, properties that are threatened with foreclosure are not very likely to end up being auctioned, especially in times of low-interest rates. The land, house or apartment is supposed to be sold on the regular market.

The entry bid for a forced auction is usually based on the market value of the property that is sold. However, in many cases, the maximum bids for a forced auction can be well below the estimated market value. Before a bid is made, the funding of the house must be absolutely safe. As a rule, a bid once made cannot be withdrawn, so you have to be really sure.

When looking for a repossession property to invest in, you should follow the following steps:

First, you should collect information about the size, location and market value. Prospective buyers have no right to be allowed to visit the property. As finding enough information about the property can be very difficult, it can be an essential advantage to have a tool that informs you about the property market and gives you a valuable overview. Our deal finder will give you an overview of all the offers in your requested area.

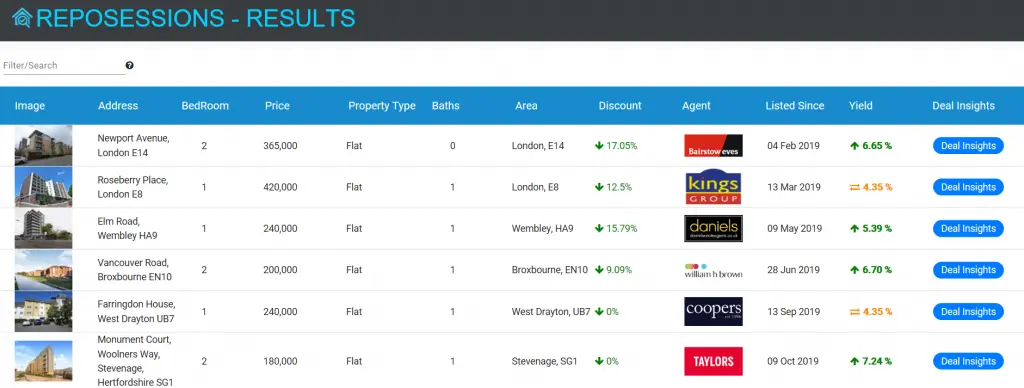

Secondly, you should calculate the costs beforehand. In order to avoid bad surprises, you should analyse what costs you will face before making the investment. That is why our deal finder will show you exact data on prices, discounts and yields.

Thirdly, you should plan ahead. Our deal finder will give you an overview of the monthly and annual costs you will have over the years. Additionally, hidden costs like renovations, insurances and property management. That way, you will be absolutely safe and can calculate whether this is the right investment for you.

Finding a repossessed property in the UK can be challenging, as:

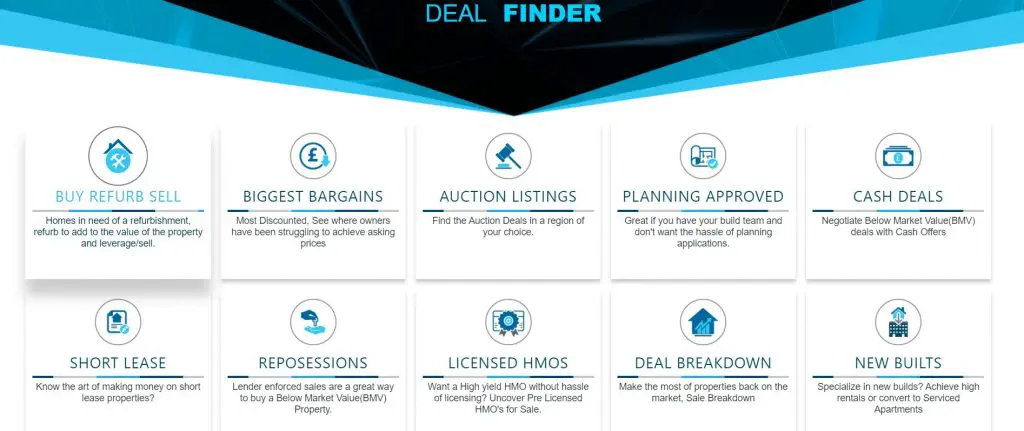

With Property Deal Insight’s Deal Finder, you will find your perfect repossessed property in the UK to have a high return on your investment. Our tool enables you to find interesting repossession deals in a region of your choice to buy your property below market value.

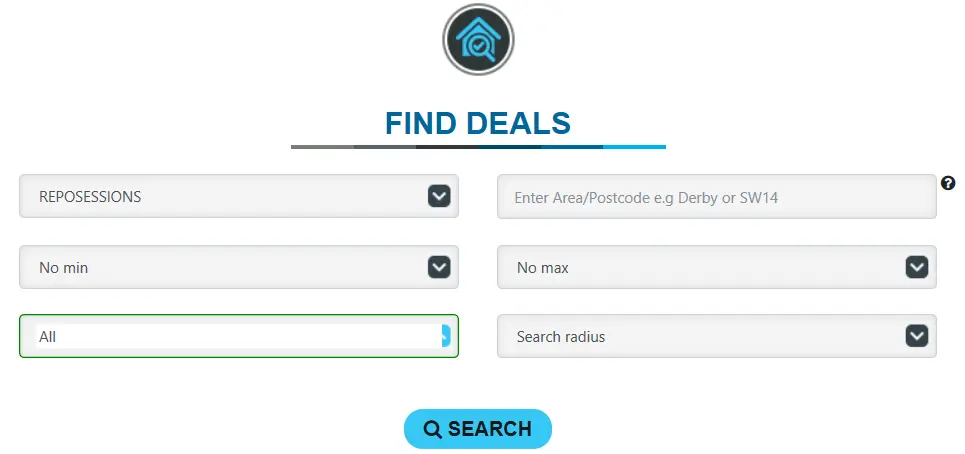

On the “Deal Finder” page, select “Repossessions”.

Here, you can search for any Repossession listings in any location e.g. London, SW14. Additionally, you can choose a property type (house, flat or land), set your price range and determine a search radius limiting the search to an appropriate distance.

Upon searching, you’ll be met with a list of results that fit your search criteria. This will let you browse through multiple properties. Included in this overview are the properties’ guide prices, an estimate of their profitability and a number of property-specific details. (Bedrooms, their specific location, listing date, etc.) Let’s look at the fourth entry on the list.

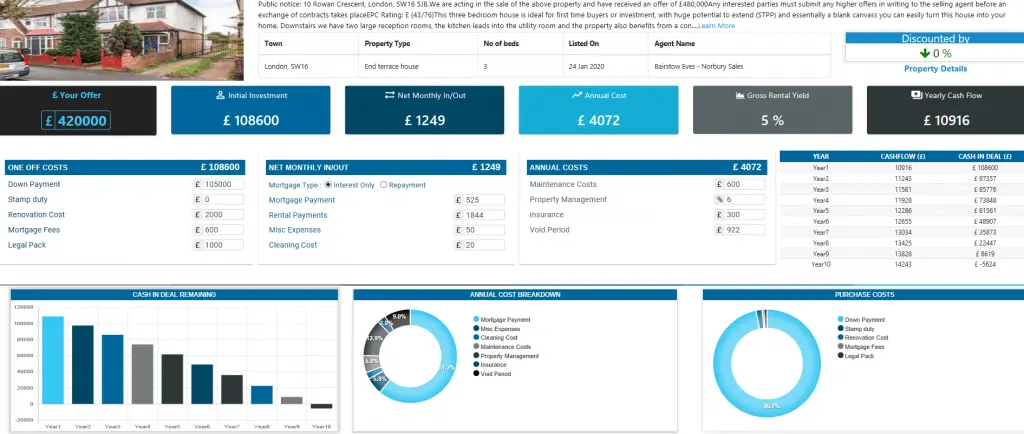

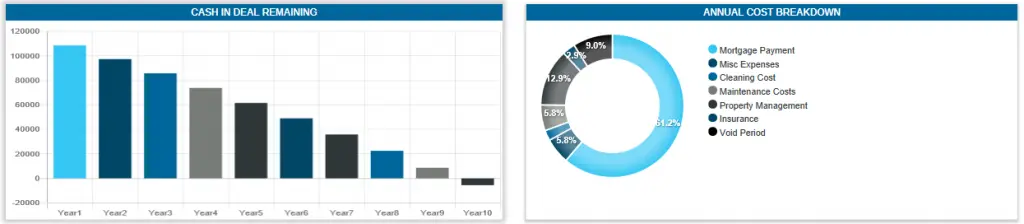

Upon clicking on the listing, you’ll see a collection of useful figures and graphs relating to the property including the guide price, estimated monthly fees, maintenance costs and your expected yearly cash flow. With this information, you can gain a clear understanding of whether a property is worth your time and money investment.

Our tools even display the amount of cash left in the deal, year on year, based on your final offer and how long it will take to get all or part of your money back. Our professional graphics make it easier for you to analyse the numbers and to see if the property in question fits your expectations.