|

Getting your Trinity Audio player ready...

|

Property investment is changing and technology is smoothing the way for investors. It’s not many years ago since the whole process of purchasing a property was time-consuming and required hard work.

Before the internet opened the doors to easy access to information due diligence required serious legwork. Before the pandemic, some of that legwork involved actual travelling – but things have changed – a lot.

Instead of spending three months to get from deciding to make a purchase to exchange of contracts (usually much longer for people just looking for their next home), it’s possible to trim months off that now.

Focus on finding the right deal

The first step for any investor is to set your goals.

- What are the strategies you want to follow?

- What kinds of properties do you want to invest in?

- What kind of price range are you looking at?

- What income goals do you have? For example, are you looking for a full-time income, to build a pension pot, or a supplementary income to pay for family holidays?

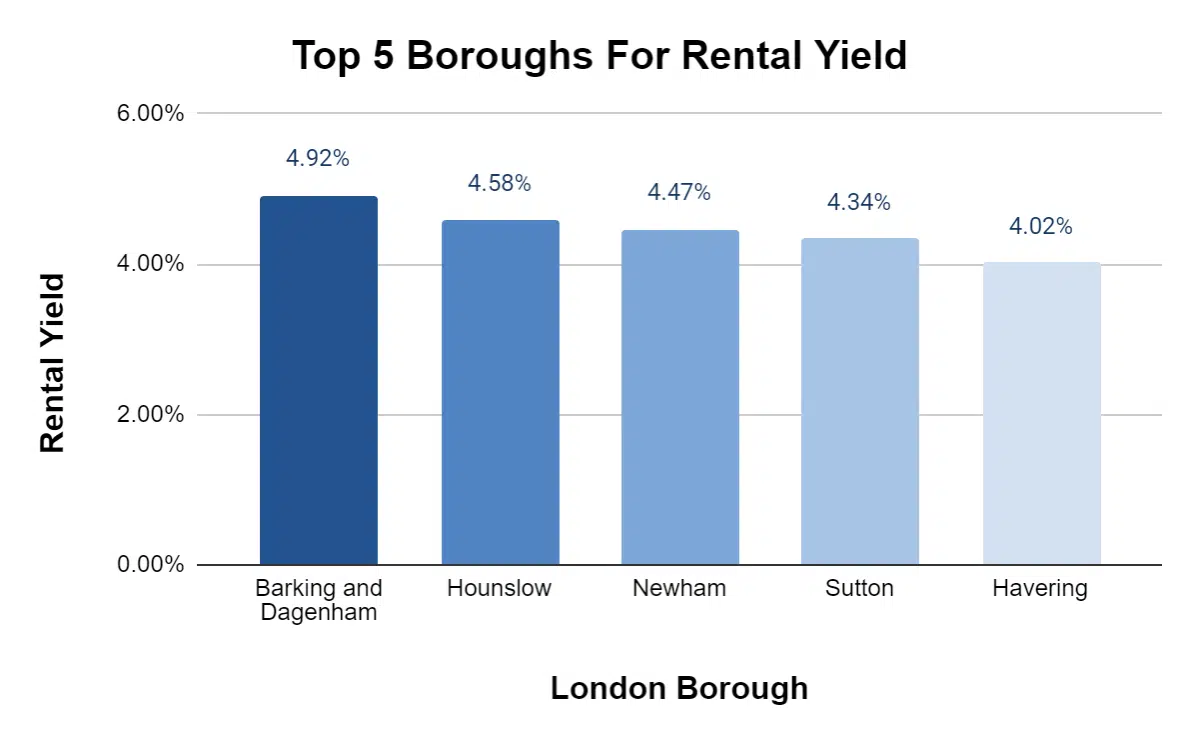

The second step is to find the right deal for you. Of course, all the big property sites let you search by area, but they don’t tell you where the best areas are to get a high rental yield or where house prices are rising quickest.

You don’t have to stick to your local area to invest; a smart investor finds the most profitable areas to meet their income goals.

That’s where heatmaps and property hotspots are critical to choosing the areas you want to invest in. Have a look at Property Heat Maps now

With this level of focus, you’ll find it easier to find the right properties to fit your needs. Although the big property sites don’t show you deals by strategy – that’s one of the things that our software does – you can search for properties at auction, Buy-Refurb-Refinance, HMOs, etc. – Check out Deal Finder now

Check out the property

Although virtual viewings have been around for a while, the systems have been refined and are more sophisticated as more and more estate agents have realised that it’s the only way to keep sales moving.

Virtual tours and viewings mean the current occupant only has one upheaval for the initial video recording, then multiple potential purchasers can see the property at its best. This has been one of the key technologies to keep the property market positive during the long lockdown periods.

There’s more than just looking around to deciding to purchase. It’s important to check out the local area analysis, do price comparisons with other similar properties and if you’re planning to let the property you need to know what the rental potential will be. Does it all then fit in with your cash flow and ROI expectations? This is the part that, historically, has taken time and effort – due diligence.

Now all this is available in seconds, in a few clicks. It takes weeks of hard graft out of the equation. You don’t even need to use a spreadsheet to work out alternative scenarios – it’s all instant. Check out our Instant Property Valuation Reports and insights features – change the monthly rental or occupancy rates and immediately see the impact on profitability, for instance.

The old school part

Unfortunately, there are still some areas technology has not yet reached.

While it’s possible to get a mortgage offer quickly and you can do online mortgage comparisons on one of the many comparison websites, actually processing the paperwork takes weeks.

Some lenders are looking at cutting down the time from application to offer, but for it to really benefit investors more lenders need to get on board.

Conveyancing takes its time and you can only move as fast as the solicitor you use (and the one the other party uses) are willing to work.

Solicitors will throw up reasons for delays such as local authority searches – but all this information is static – it doesn’t vary from day to day. There’s really no reason why it couldn’t be available in the online search form. The stumbling block is that local authorities haven’t embraced that technology yet.

There are secure means of signing documents available (e.g. DocuSign); there’s no longer a need to post documents out. That can cut days out of the process.

Solicitors don’t generally operate with any sense of urgency. Property purchasers have accepted that ‘these things take time, but they don’t need to take anywhere near as long as they do!

Tools for property investors

Once contracts are exchanged there’s plenty of tech to help. Sites where you can switch energy providers, broadband and phone services (like USwitch), etc., sites to find reliable trades to help with refurbs (like CheckATrade), sites that will automate the whole moving process – and if you want to streamline the management of your property portfolio you can subscribe to a portfolio management service.

Digital offerings slim down the process and increase efficiency – and, long-term, profitability as you spend less time and get better outcomes.

The future

As property investors look for more services, better efficiency, time saving and more, there are huge opportunities to develop systems and software that pull all the services investors need into a one-stop-shop. Digitalising makes life easier and speeds everything up.

PropTech 2.0 is passing and we’re moving to 3.0 and beyond. It’s time for some parts of the property chain to join the 21st Century.

More and more businesses of the future beginning to are leveraging APIs and Data to integrate and provide truly world-class service to their customers. If you want to know how your business can benefit from this PropTech revolution book your free consultation now

Partner with us

Speed up your sales cycle from months to days and explode your sales!

BOOK YOUR FREE CONSULTATION NOW